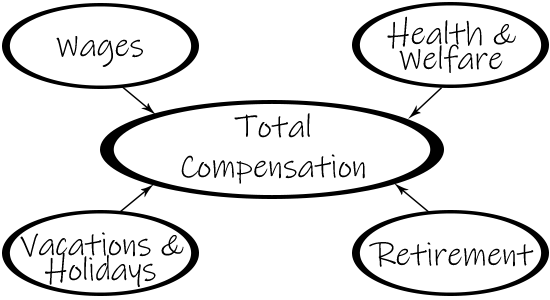

Total Compensation

Total Compensation is more than just the cash that is deposited in a bank account. All forms of compensation and the dollar value of employer sponsored benefits are considered when examining the state employee compensation package. Total compensation is indicated on the pay stub; and is the sum of direct compensation and indirect compensation.

Direct Compensation

Otherwise known as cash compensation, this portion of your total compensation is in the EARNINGS portion of your pay stub.Direct compensation is money paid directly to the employee as a result of:

- Hours worked (regular, overtime, and retroactive)

- Leave usage (vacation, sick, military, and jury duty)

- Holiday pay and paid administrative leave

Indirect Compensation

This portion of your total compensation is in the STATE TAXES/CONTRIBUTIONS portion of your pay stub. As a condition of employment with the State of South Dakota, state employees have many different forms of indirect compensation available to them:

| Code on paystub | Description |

|---|---|

| ER PdIns (Health & Life Insurance) |

Your agency pays your employee premium to the state employee health plan. |

| Med EE/Med ER (Medicare) |

Both employers and employees in the U.S. are required to pay Medicare taxes to help fund federal insurances. |

| Retire | The State of South Dakota contributes a matched amount on your behalf to the South Dakota retirement system. | RA (UI) (Reemployment Assistance) |

The state is a liable employer contributing to the Unemployment Insurance Trust Fund. | Soc Sec (Social Security) |

Both employers and employees in the U.S. are required to pay Social Security taxes to help fund federal insurances. |

| WorkComp (Workers' Compensation) |

The state provides Workers' Compensation. |

Leave Accruals

Leave AccrualsAs a benefited state employee, you accrue both vacation and sick leave hours each pay period. While their cash value only appears as part of your total compensation only when it is used, it can still be considered compensation because it has a future value. The hours you use actually pay you for not working!

Tax Savings

Tax SavingsMany of the deductions from earnings are made as pre-tax contributions. These lower tax liability.