Critical Illness

Click here for FY25 Critical Illness Information.Critical Illness is coverage designed to protect you and your covered family members if you are diagnosed with a major illness. This type of plan provides you with extra funds to meet the demands that come with critical illness health emergencies, which often prove to be costly.

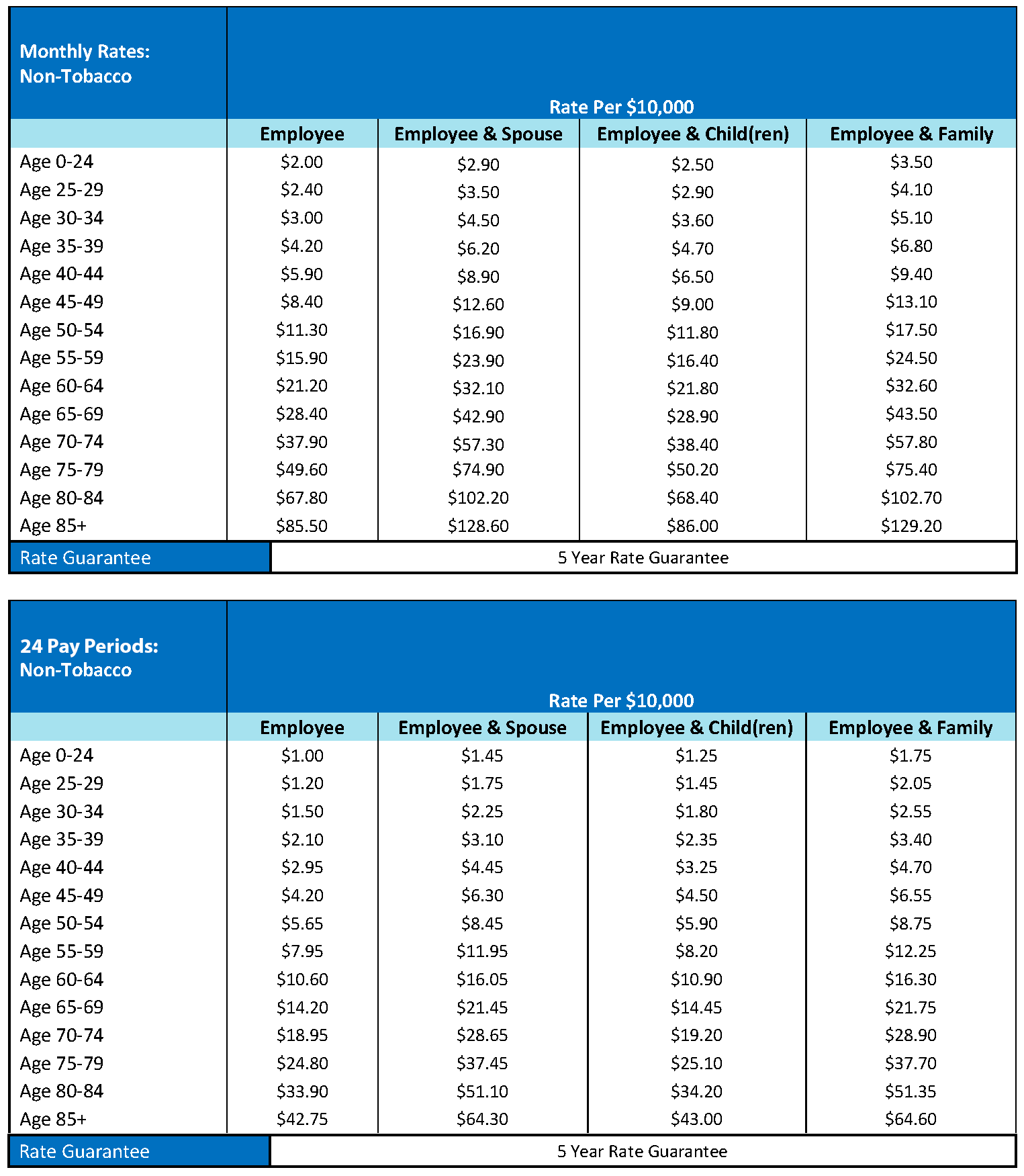

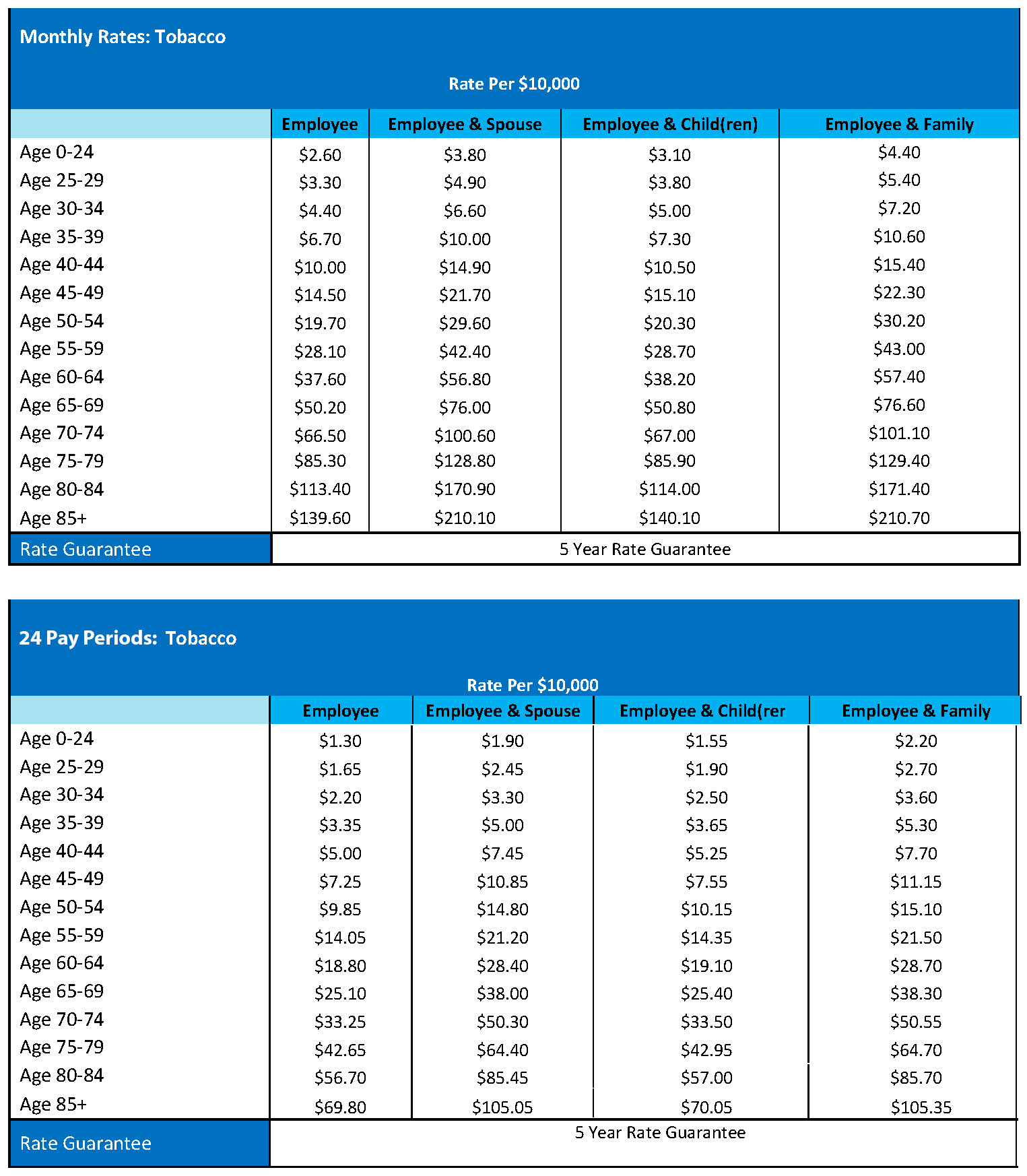

Whether you need the extra money to pay for medical treatment, to help offset travel costs associated with treatment, or to just pay your everyday expenses such as groceries or your rent, Critical Illness is there to help you when you need it. This benefit provides you with a lump-sum payment per critical illness, and you can choose to enroll for increments of $10,000, $20,000 or $30,000.

Critical Illness Coverage Documents• Critical Illness Regultory Disclosure Document

• Accident Certificate Regulatory Disclosure Document

• Critical Illness Outline of Coverage

• Critical Illness Tobacco-Use Question

• Critical Illness All States

• Critical Illness and Cancer Claim Form

• Critical Illness FAQ

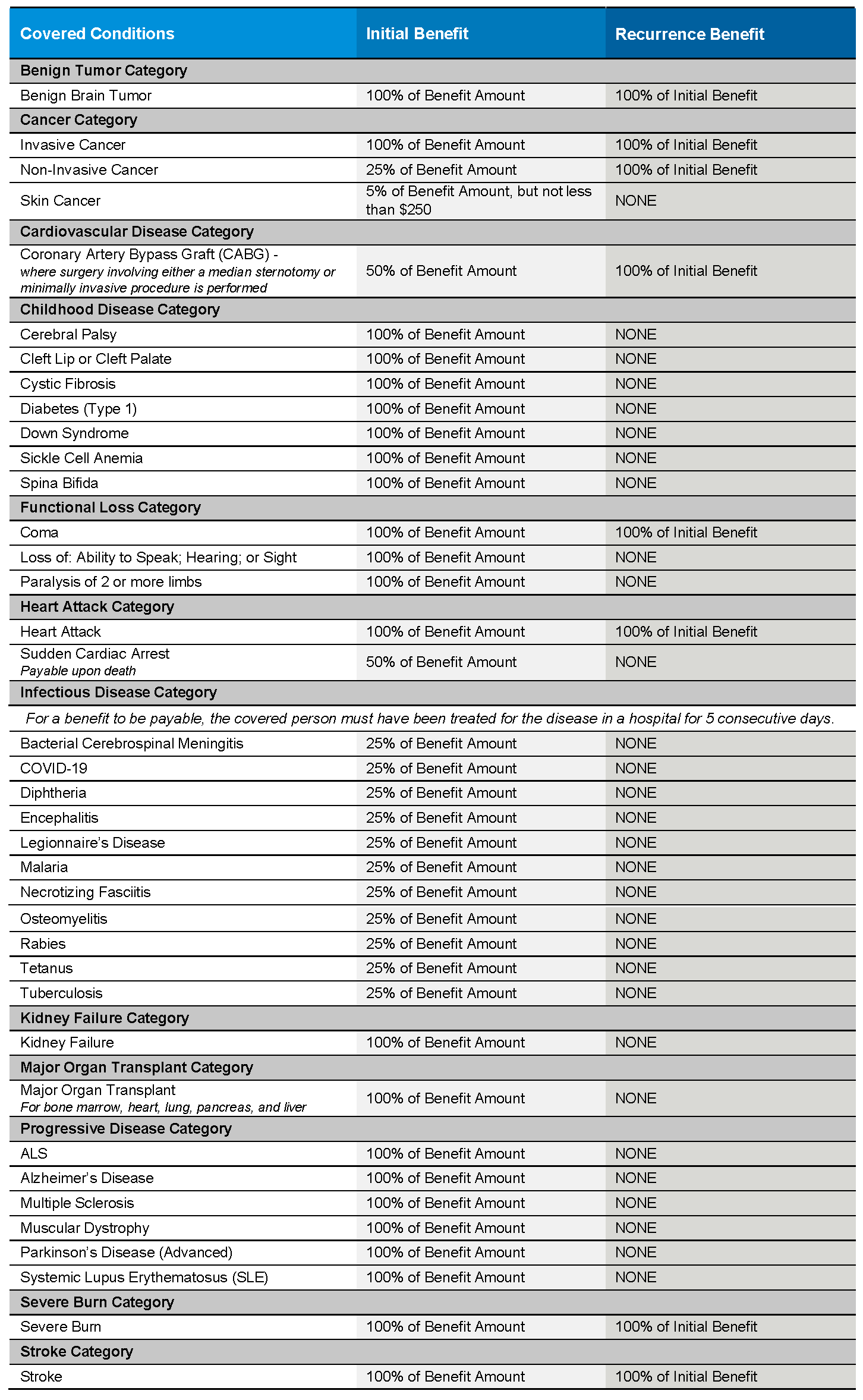

- The following conditions are covered under Critical Illness coverage:

Please Note: If you have previously been diagnosed with one of these conditions, it may be subject to limitations and exclusions.