Health Savings Account Updates for 2020

Health Savings Account Contribution Limits for 2020

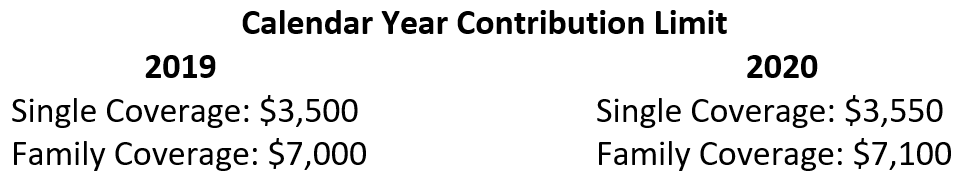

With the start of the new year right around the corner, we wanted to remind all benefits members currently on the High Deductible Health Plan with a Health Savings Account (HSA) about the new contribution limits.

Why is it changing?

These limits are mandated by the IRS and are updated every calendar year. When calculating your HSA contributions for the year, remember to include both the money you receive from the State and any contributions you have made through payroll or directly to your account.

Please note: If you are 55 or older, you can contribute an additional $1,000 in calendar year 2020. If you need to adjust or stop your HSA payroll contributions to be within IRS maximum limits, please complete and submit the HSA Payroll Deduction Form.

How do I qualify for a Health Savings Account?

The South Dakota State Employee Benefits Program has two health plans – a Low Deductible Health Plan and a High Deductible Health Plan. A health savings account is only available through the High Deductible Health Plan. Everyone who elects the High Deductible Health Plan has the option to open a health savings account through our vendor Discovery Benefits.

Instructions for opening your Health Savings Account can be found here: https://bhr.sd.gov/benefits/FY19Files/HSACreatingwithDB.pdf

Not everyone is eligible to have an HSA. Please refer to the Decision Guide for details.

State Contribution to the Health Savings Account

Effective immediately, members and covered spouses (if applicable) who enroll in the High Deductible Health Plan for FY21 will need to complete all three wellness qualifications in order to receive any State contribution to a Health Savings Account.

In the past, members who did not complete the three wellness qualifications received lower amounts, while those who did received the full state contribution. Members and covered spouses (if applicable) who do not complete the three qualifications before the April 1, 2020 deadline will not receive any State contribution to their Health Savings Account.

Employees hired or spouses added to the health plan after July 1, 2019 are not required to complete the three wellness qualifications to receive the incentive for FY21. They will be required to complete the qualifications for the next fiscal year.

A complete FAQ is available regarding this policy change.

Employee payroll contributions

All employees with a health savings account have the option to make payroll contributions each pay period. Unlike most benefits elections, which need to be made during Annual Enrollment, you may make changes to your HSA payroll contribution any time of the year. These changes can be made by completing the HSA Payroll Deduction Form.

The State of South Dakota does not monitor employee HSA contributions. Those who decide to change their payroll contributions will need to do their own “math” to verify that they are within IRS regulations. Employees that change from single to family coverage or vice versa should also remember that the IRS maximum will change depending on which level of coverage they move to.

Questions?

Visit our Health Savings Account page or call contact the benefits division at 605.773.3148.